The SEC notified UniSwap Labs that it might take enforcement action against it, and the company said it was “ready to fight”.

A proposed lawsuit notice from US regulators – which Uniswap is “ready to fight” – sent the token price of UNI $9.23 stumbling to a six-week low.

In the hour following Uniswap’s announcement that it had received a Wells Notice, a notification that the SEC is planning to take enforcement action, UNI dropped 10% from $11.21 to $10.

According to Cointelegraph Markets Pro, UNI has reached its lowest price since late February.

A blog post from UniSwap regarding the Wells notice claimed UNI was not a security or a broker under U.S. law.

Neither the SEC nor its spokesperson would comment on “whether an investigation is underway or not.”

In an article on X, Consensys senior counsel and regulatory matters director Bill Hughes clarified that the lawsuit must first be approved by the SEC’s five commissioners, including chair Gary Gensler.

There are two commissioners that won’t disagree, and two commissioners that will disagree,” Hughes wrote. As a result, a lawsuit is inevitable, but there isn’t one yet.”

It is “extremely doubtful” that the SEC will target UNI holders or protocol users, he told those who were “freaked out.”.

According to John Reed Stark, former SEC Internet Enforcement Chief, recipients of Wells notices have the opportunity to argue why a lawsuit should be dismissed.

Wells notice recipients “always amaze” him when they respond with obnoxious/insulting PR campaigns, such as the one Uniswap seems to be conducting.”

Any SEC lawyer will agree that berating the SEC, calling them names, etc., is a weak, risky, and losing strategy.”

By accusing the SEC of abusing its power and “lambasting its anti-innovation enforcement paradigm,” Stark said Uniswap had repudiated a “tired, anemic, old and failed monologue.”

A voluminous and robust federal complaint is expected to be filed by the SEC Enforcement staff, ensuring it survives the usual motion to dismiss, wins against the typical summary judgment motion, and wins almost every other litigated issue in the future, he said.

Uniswap’s former general counsel Gabriel Shapiro wrote on X that he believes the SEC will lose if it claims Uniswap is a securities exchange, but will win on securities issues with UNI.

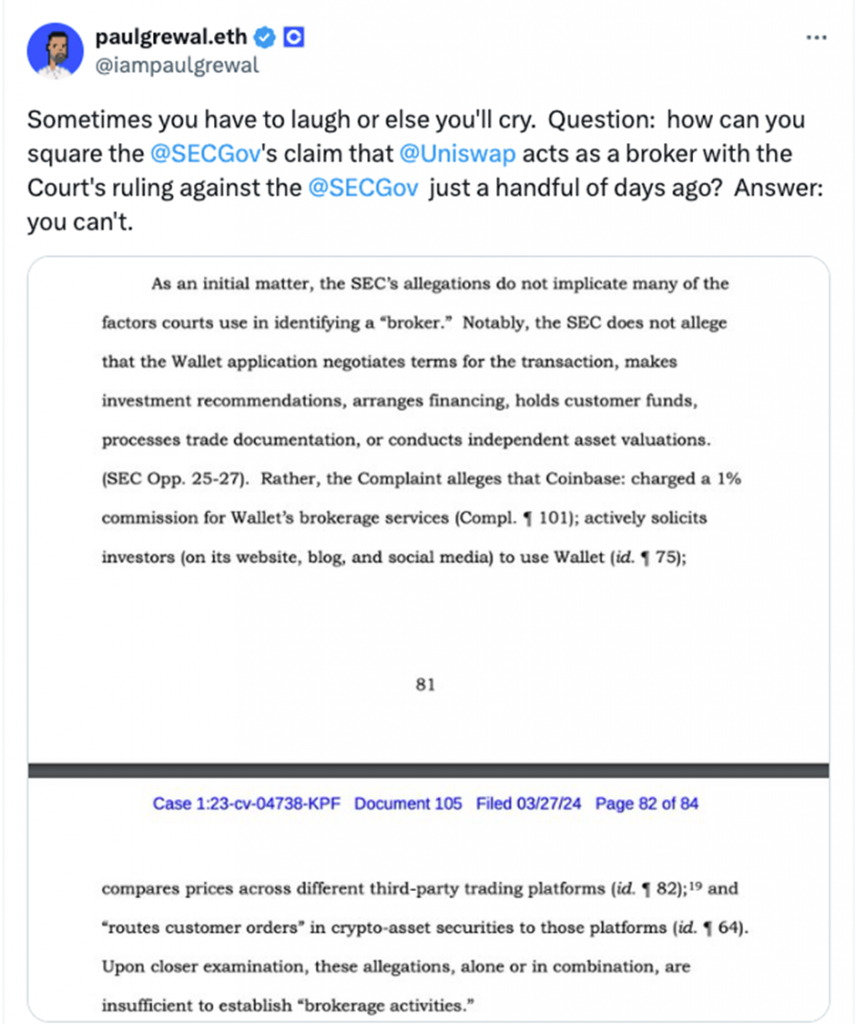

Uniswap can’t argue its position if the SEC claims it is a broker, according to Coinbase’s chief legal officer, Paul Grewal.

Coinbase’s decentralized Coinbase Wallet, he pointed out, was not used for brokering as claimed by the SEC in its suit against Coinbase last month.

WHERE TO CONTACT US:

Website : WWW.CRYPTOTRADE1.COM

Twitter : https://twitter.com/cctrade11

Telegram : https://t.me/cctrade1

Facebook : https://www.facebook.com/cryptotrade11

Instagram : www.instagram.com/cryptotrade1/

YouTube : www.youtube.com/cryptotrade1

Email : info.cryptotrade1@gmail.com