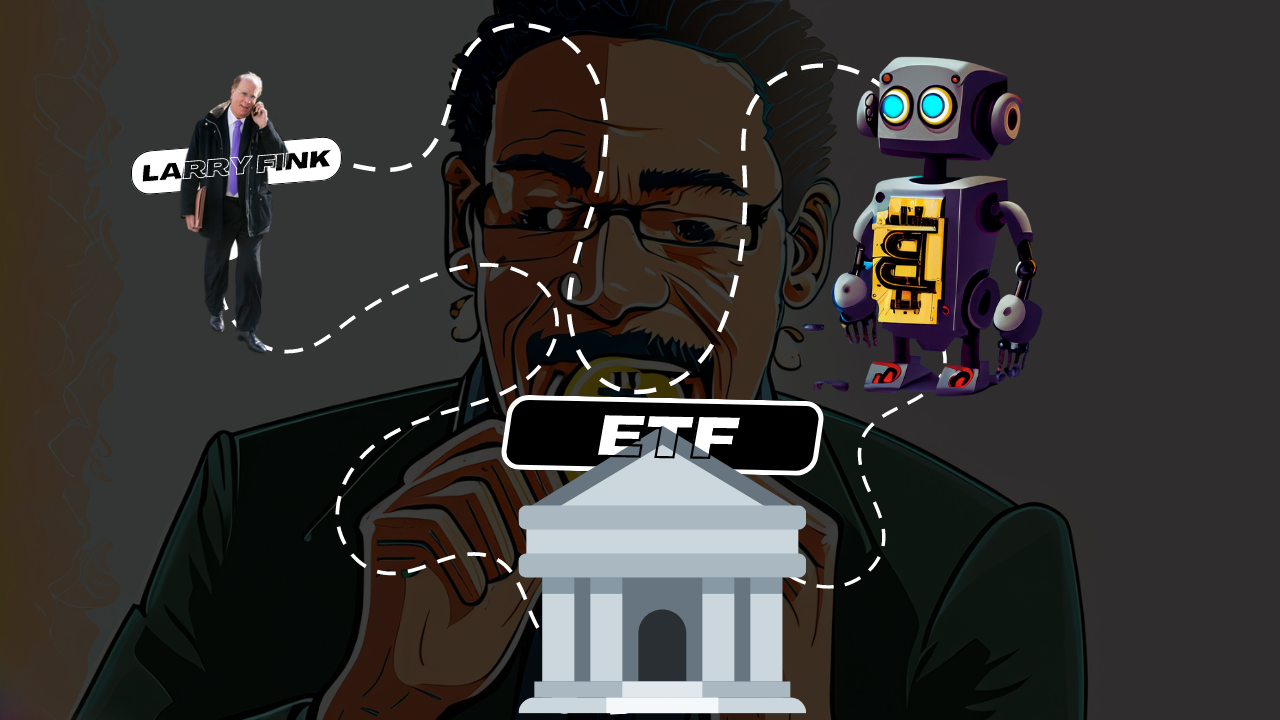

BlackRock, the world’s largest asset manager with over $9 trillion in assets under management, has just filed for a Bitcoin exchange-traded fund (ETF) application with the US Securities and Exchange Commission (SEC). BlackRock will be using Coinbase (COIN) Custody for the ETF and the crypto exchange’s spot market data for pricing. Coinbase declined to comment.

This can have a significant effect on the cryptocurrency industry, especially considering that BlackRock manages around 10 times the market cap of the entire cryptocurrency industry at the time of writing. This article will explore how this financial instrument might work, as well as how it could help drive the crypto market.

What is a Bitcoin ETF?

A Bitcoin ETF is a type of investment vehicle that tracks the price of Bitcoin and allows investors to buy and sell shares of the fund on a regulated stock exchange. Unlike buying Bitcoin directly from a crypto exchange or a wallet, a Bitcoin ETF does not require investors to deal with the technical aspects of storing, transferring, or securing their digital assets. Instead, they can simply buy shares of the ETF through their brokerage accounts, just like any other stock or fund. The crypto equivalent of an ETF can include stable coins and synthetic assets, which are designed to track stock prices.

The ETF issuer is responsible for acquiring and holding the underlying Bitcoin assets in accordance with the SEC’s rules and regulations. The ETF also has to publish its holdings and NAV (net asset value) daily and undergo regular audits and inspections by independent third parties. Furthermore, a Bitcoin ETF can facilitate more trading volume and liquidity for the crypto market, as it can attract more institutional and retail investors who may otherwise be reluctant or unable to invest in Bitcoin directly.

Why is BlackRock’s Filing Important?

BlackRock, which has been historically cautious and skeptical about crypto, has changed its stance and recognized the potential and value of Bitcoin as an asset class. In fact, BlackRock’s CEO Larry Fink has recently said that he is “fascinated” by Bitcoin and that it could become a “great asset class”. A change in sentiment coming from the biggest asset manager in the world could inject renewed hopium into crypto markets leading to a significant increase in the value of Bitcoin. And as you probably know, Bitcoin is the main market driver for crypto, so if Bitcoin gains, alts gain too.

The SEC has so far rejected or delayed every Bitcoin ETF application that it has received, citing concerns about market manipulation, fraud, custody, valuation, and liquidity. Gary Gensler, the current chairman of the SEC (hopefully not for very long) has recently taken Binance, Coinbase and to court, for allegedly offering unregistered securities. It was rather easy to make that claim when Gensler calls all crypto apart from Bitcoin security. It remains to be seen whether the Bitcoin ETF application will be approved, knowing Gensler’s crypto-phobic stance.

If the application does pass, the cryptocurrency industry wins twice over. Not only will Bitcoin, and by extension all alts get considerably more exposure to markets, driving the price and adoption way up. More importantly, it underlines Gary Gensler’s and the SECs inability to regulate the cryptocurrency industry in a pertinent way. Instead of creating a useful regulatory framework for cryptocurrency, the SEC would rather allow Blackrock to provide the market with what essentially is a Bitcoin ETF.

The point I’m trying to make is that the SEC listens and sides with organizations that lobby with them, and Blackrock probably knows one or two things about lobbying. This is also why the SEC never sued FTX and Sam Bankman-Fried. So if the ETF gets approved, Coinbase and Binance could argue this in court.

This could create a domino effect for other asset managers and financial institutions to follow suit and launch their own Bitcoin ETFs or other crypto-related products. BlackRock’s filing could also put more pressure on the SEC to act faster and approve a Bitcoin ETF sooner rather than later. If BlackRock succeeds in launching a Bitcoin ETF, it could be a game-changer for the crypto industry, as it could bring more legitimacy, credibility, and capital to the space.

BlackRock’s Market Impact

As one of the most influential asset management companies globally, BlackRock’s entry into the crypto market with a spot bitcoin ETF has the potential to reshape the investment landscape. The company’s extensive resources and expertise could bring a level of credibility and trust to the world of cryptocurrencies, enticing institutional investors who have thus far remained cautious. If approved, the iShares Bitcoin Trust could open the floodgates for a multitude of similar products, creating a seismic shift in the market and expanding crypto investment opportunities.

If the SEC approves BlackRock’s spot bitcoin ETF, it would likely have a transformative effect on the cryptocurrency market. The influx of institutional capital through a trusted and regulated investment vehicle could lead to increased liquidity and stability in the bitcoin market. It would attract a broader range of investors who may have been hesitant to enter the crypto space due to perceived risks or regulatory uncertainty.

Benefits of a Spot Bitcoin ETF

Increased Accessibility: A spot bitcoin ETF would provide a user-friendly investment avenue, eliminating the complexities associated with purchasing and storing cryptocurrencies independently. Investors could gain exposure to bitcoin through a familiar and regulated financial product, attracting a wider range of market participants.

Mitigated Risks: By investing in a spot bitcoin ETF, investors can potentially mitigate risks associated with holding cryptocurrencies directly. This approach offers protection against hacking, theft, and loss due to operational errors. Furthermore, the fund’s professional management may help reduce volatility and enhance risk management strategies.

Enhanced Liquidity: A spot bitcoin ETF would likely offer improved liquidity compared to existing bitcoin investment options. This liquidity would enable investors to enter or exit positions swiftly, potentially reducing the impact of price fluctuations and providing greater flexibility for portfolio management.

Regulatory Oversight: As a regulated financial product, a spot bitcoin ETF would be subject to SEC oversight and compliance requirements. This regulatory scrutiny aims to safeguard investors’ interests, ensuring proper disclosures, transparency, and adherence to established market rules.

A Game Changer in the Crypto World?

The world’s largest asset manager, BlackRock, is making waves in the crypto sphere. The financial giant has filed paperwork for a Bitcoin ETF, marking a significant step towards mainstream crypto adoption.

The Power Move: BlackRock’s entry into the Bitcoin ETF space could be a game-changer. With over $9 trillion in assets under management, BlackRock’s influence in the financial world is undeniable. Its Bitcoin ETF could potentially bring a flood of institutional money into the crypto market, bolstering Bitcoin’s price and credibility.

The Regulatory Battle: it’s not all sunshine and rainbows. The SEC has yet to approve a Bitcoin ETF, and BlackRock’s application could face regulatory hurdles. But if approved, this could be a watershed moment for Bitcoin and the broader crypto market.

Why is this a big deal? As the regulatory landscape continues to evolve, launching a Bitcoin ETF backed by an industry giant like BlackRock could pave the way for further institutional adoption of cryptocurrencies.

BlackRock

Blackrock was founded in New York in 1988 by eight financial professionals, including Larry Fink, Susan Wagner, Barbara Novick and Robert S. Kapito, who wanted to make the financial advisory industry more transparent and efficient.

The company is best known for bringing innovation to what is considered a very pragmatic field by developing innovative portfolio management software known as Aladdin.

As time passed, Blackrock started to acquire the portfolios of several large firms, including Merrill Lynch Investment Management and Barclay’s Global Investors (BGI). The company eventually became the leading player in the asset management industry.

BlackRock became a publicly-traded company in 1999. It completed its initial public offering (IPO) on the New York Stock Exchange (NYSE) under the ticker symbol BLK at $14 a share. Back then, the company had $165bn in assets under management.

In over two decades of trading, BLK stock rose to as high as $971 in September 2021, its record level.

BlackRock is one of the world’s leading providers of investment, advisory and risk management solutions. We are a fiduciary to our clients. We’re investing for the future on behalf of our clients, inspiring our employees, and supporting our local communities.

BlackRock was founded in 1988 by Larry Fink,

Robert S. Kapito,

Susan Wagner,

Barbara Novick,

Ben Golub,

Hugh Frater,

Ralph Schlosstein,

and Keith Anderson to provide institutional clients with asset management services from a risk management perspective.

BlackRock shareholders

The following is a list of BlackRock major shareholders, according to data compiled by WallStreetZen as of 6 March.

- The Vanguard Group – 9.04%

The Vanguard Group is a US-based asset management firm that oversees more than $8tn in assets for both individual and institutional investors. This financial services firm may own BlackRock (BLK) stock through its various investment vehicles, including exchange-traded funds (ETFs) and mutual funds.

- State Street Corp – 4.21%

State Street (STT) is one of the most successful financial services companies in the US. The asset management firm overlooks assets worth over $4tn. It is one of the biggest BlackRock shareholders.

- Bank of America – 3.45%

Bank of America (BAC) or BofA is the second biggest bank in the US after JP Morgan (JPM), and one of the country’s Big Four banks, founded in 1923. BofA’s investment management arm BofA Securities would likely be the bank’s division holding BlackRocks stock on behalf of clients.

- Temasek Holdings Private – 3.39%

Temasek is the investment arm of the Singaporean government. The company is managed by the nation’s Minister of Finance. Temasek invests the majority of its assets in Singapore, China and the Americas, including the US. The fund is a major shareholder of Blackrock.

- Charles Schwab Investment Management – 2.22%

Charles Schwab (SCHW) offers investment management and advisory services, mainly in the US and the UK. It was established in 1971 and named after its founder, an American investor Charles Robert Schwab.

BlackRock major shareholders among insiders

Another data collector GuruFocus estimated that insiders owned 3.02% of all outstanding common shares of BlackRock at the time of writing. These shares are granted to insiders by the company via stock options as part of their compensation package, or they could have been bought back when the firm was founded.

The following individuals were considered BlackRock biggest shareholders among the company’s insiders, as of 6 March:

- Laurence D. Fink – 520,124 shares

Laurence D. Fink is the CEO and co-founder of BlackRock. Along with seven colleagues, he started the company. As of 31 January 2023, he owned 520,126 making him the biggest individual shareholder.

Before founding BlackRock, Fink was Management Director of the First Boston Corporation, an investment bank that was later acquired by Credit Suisse (CS).

- Susan L. Wagner – 429,362 shares

Susan Wagner is a former executive and one of the co-founders of BlackRock. She occupied the position of Vice Chairman of the asset management firm until 2012. She has served as COO and Head of Corporate Strategy.

As of 17 January 2023, Susan owned 429,362 shares of Blackrock, making her the second largest shareholder.

- Robert S. Kapito – 210,104 shares

Rob Kapito is the president of Blackrock, head of the Global Operating Committee and a member of the company’s Global Executive Committee. Kapito is also a founding member.

Kapito owned 210,104 shares of BLK as of 31 January 2023, over twice less than Wagner.

WHERE TO CONTACT US:

Website : WWW.CRYPTOTRADE1.COM

Twitter: https://twitter.com/cctrade11

Telegram : https://t.me/cctrade1

Facebook : www.facebook.com/cryptotrade1

Instagram : www.instagram.com/cryptotrade1/

YouTube : www.youtube.com/cryptotrade1

Email : info.cryptotrade1@gmail.com