Cardano’s native token ADA has recently fallen 40% from its all-time high to a current price of $1.84.

Other projects have performed more strongly. Competitor Solana gained in the same period and has now “flipped” Cardano in the cryptocurrency top 10.

The launch of smart contracts on Cardano has also been a joke. Whilst this functionality did technically launch, a critical piece of infrastructure was delayed. This meant that a lot of developers have completed dApps they can’t release to the public.

Meanwhile, projects such as Solana, Algorand, and Elrond already have dApp support. These projects also boast faster transaction times with low fees.

So does this mean Cardano is dead? Game over?

I don’t think so, and here’s why…

ADA is underpriced

ADA’s value increased 1500% between January and September 2021. These gains were based on a platform with:

- No smart contract support

- Poor staking yields

- Mediocre transaction speeds.

I would argue that until recently ADA has therefore been overpriced.

The market “priced in” things like dApps and smart contracts before they were delivered. The project was running on pure hype.

However, the tables have now turned. ADA’s price is significantly deflated compared to competitors. And Cardano finally has smart contracts.

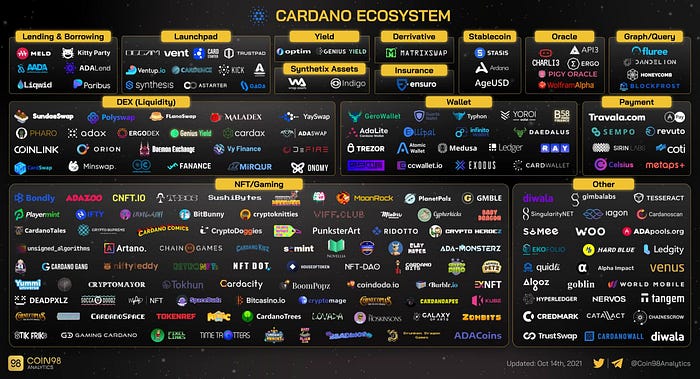

Not only that, but Cardano has a huge ecosystem of projects already built and waiting to be deployed.

Projects like the Yoroi and Nami wallets are already in use, with Nami providing Web3 integration.

Wide-ranging projects launching soon include:

- Sundae swap

- Adax

- ErgoDex

- SoMee

- Artano

- CNFT

- Cardstarter

- Liqwid

- Indigo Protocol

- Novellia

For these to roll out the Plutus backend needs to be deployed. This is scheduled imminently. Watch this space!

The future is rollup-centric

Cardano is 100% decentralized. This means that none of the blockchain validation is carried out by the organization behind Cardano’s development.

Instead, it is done by over 3000 independent staking pools.

In addition to being highly decentralized, Cardano’s blockchain is provably secure.

What does this mean for developers and users…?

It means that Cardano is as close as we can get to a fully trustless and permissions blockchain. It means that developers can build whatever they like in the knowledge that no central on-chain authority will be able to remove or change it.

Speed

A lot has been made of Cardano “only” supporting 7 transactions per second. This sounds very slow compared to something like Solana which boasts over 65000 TPS.

There is a good discussion on this in the CryptoCurrency Reddit. But key takeaways are:

- 7 TPS is a practical not theoretical limit, and can easily be increased

- Real-world use doesn’t currently require a higher limit

However, fixating on this is missing the bigger picture…

The future will be layer 1 blockchains with layer 2 scaling solutions

Scaling up

In simple terms, a layer 2 scaling solution is a smaller, faster blockchain that can dramatically speed up transaction processing whilst inheriting the security and decentralization of the layer 1 chain it is connected to.

The time and cost needed to develop and deploy a layer 2 chain are far smaller than developing a layer 1. If you want some evidence, take a look at the Optimism ecosystem and how quickly it has been adopted.

According to the Ethereum foundation, this is why layer 2 solutions are needed:

- Some use-cases, like blockchain games, make no sense with current transaction times.

- It can be unnecessarily expensive to use blockchain applications.

- Any updates to scalability should not be at the expense of decentralization or security — layer 2 builds on top of Ethereum.

Note that last bullet point!

Now, it’s much much harder to decentralize and secure a fast layer 1 network, than it is to add layer 2 scaling to an already secure and decentralized layer 1.

So, given how effective layer 2 solutions are, what are you going to bet on…?

- Option 1: the fast layer 1 protocol that needs to decentralize

- Option 2: the decentralized layer 1 that needs to scale up

With the Hydra layer 2 scaling solution, Cardano will be able to achieve over 2 million transactions per second. All of this whilst leveraging Cardano’s underlying layer 1 security and decentralization!

Conclusion

If you’re considering which super-fast layer 1 blockchain will kill Ethereum, you’re looking for the future in the place. Ethereum doesn’t need to get faster and neither does Cardano. They just need to be secure and decentralized, which they are. Layer 2 scaling can do the rest.

Cardano’s development has been very slow-paced compared to competitors. But it doesn’t matter how fast you are if you’re building the wrong thing. I would argue that Cardano has its priorities right, and in this case, slow and steady will ultimately win the race.

Cardano has great partnerships and an ecosystem ready to run. The next 6 months will be very exciting indeed!