The SEC is expected to approve a spot Bitcoin ETF soon. The Fed’s interest rate could make or break Bitcoin’s price rally in October.

- In anticipation of a potential surge in Bitcoin prices, Bitcoin enthusiasts and investors are anticipating the SEC’s approval of a Bitcoin spot ETF, which will attract more investment into the cryptocurrency.

- In particular, the Federal Reserve’s upcoming December meeting will have a significant bearing on Bitcoin’s price movement. Because borrowing costs are cheaper and risk assets like Bitcoin are in higher demand, a rate cut could boost Bitcoin prices.

- Fed rate adjustments are influenced by the state of the economy, as recent GDP growth has been robust. Increasing rates to curb inflation may slow Bitcoin’s rise if growth continues. Conversely, a slowdown in growth may lead to rate cuts, potentially fostering conditions for a Bitcoin rally similar to the one during the 2020 pandemic.

Bitcoin market watchers are focused on the long-awaited SEC approval for a Bitcoin spot ETF exchange. Cryptocurrency traders and institutional finance expect the price to rally higher when that happens.

Meanwhile, the Fed recently held interest rates steady for the time being at its November meeting. The central bank’s next move could have a wide-ranging impact on Bitcoin prices in cryptocurrency markets.

Bitcoin Price and The Fed

After a tremendous October rally, Bitcoin’s price may depend on what the Fed does at its December meeting. A recent update on FXStreet Crypto explains:

- Ahead of the Federal Reserve’s interest rate announcement, Bitcoin and Ethereum prices are close to key psychological levels, $34,400 and $1,800.

- During the week leading up to the Fed’s decision, the prices of the top 10 cryptocurrencies increased.

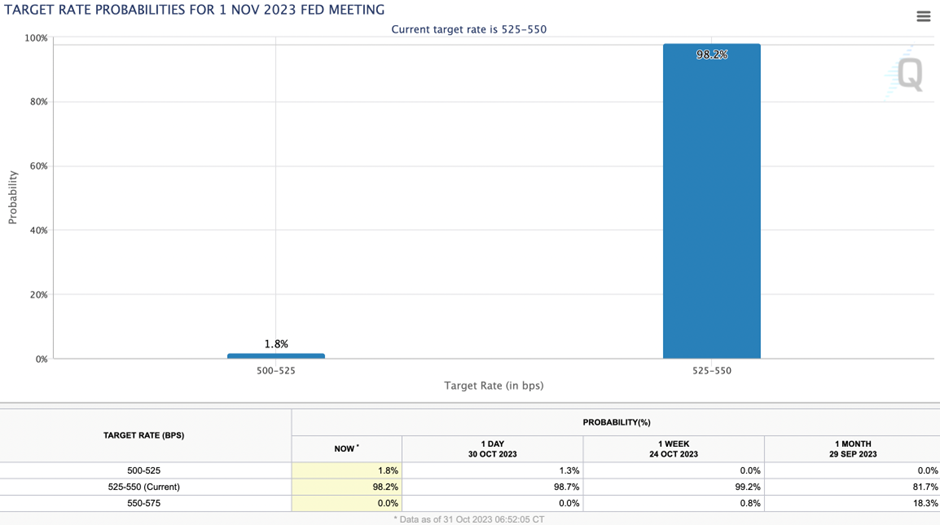

- It is predicted that the US Federal Reserve will leave interest rates unchanged on Wednesday by 98.2% of traders.

October 2023 was another profitable month for Bitcoin holders. There is a chance that Bitcoin’s price rally will be made or broken by the upcoming US Federal Reserve interest rate decision.

It is likely that altcoins like Ethereum will follow Bitcoin’s lead. Most market participants expect the US central bank to keep the interest rate unchanged and a small percentage anticipate a rate cut.

Cryptocurrency prices and the US Fed’s interest rate outlook: Two scenarios

The US Fed maintains its interest rates in scenario 1

Based on the CME Fed Watch Tool, rates will remain unchanged by the US central bank on November 1. Since the Fed left interest rates unchanged in September 2023, Bitcoin price did not show any dramatic movements. The Federal Reserve’s November 1 decision is expected to have a similar effect.

BTC could experience short-term volatility, hovering around $34,400. A retracement of BTC’s weekly gains is likely to occur momentarily, but soon after the price may recover.

Bitcoin’s rally has been largely driven by the SEC’s anticipated approval of a BTC ETF. The SEC’s decision could therefore influence BTC price directly, as opposed to unchanged interest rates.

Interest rates are cut by the US Federal Reserve in scenario 2

The probability of a rate cut is 1.8%, according to market participants. It is expected that risk assets such as Bitcoin and altcoins will rally if interest rates are cut. Rate cuts typically make borrowing funds and leveraging risk assets like Bitcoin cheaper. Prices are likely to rise due to an increase in demand and inflow of funds.

The possibility of a rate cut is highly unlikely. Jerome Powell’s speech will be closely watched by investors to determine whether the Fed will raise interest rates more often.

Prices for Bitcoin and Ethereum are hovering at crucial levels

Bitcoin and Ethereum, the two largest cryptocurrencies by market capitalization, are hovering around crucial levels ahead of Wednesday’s announcement. Bitcoin price sustained above $34,400 while Ethereum is trading above its $1,800 psychological level.

The reduction in interest rates makes it cheaper to borrow funds and leverage risk assets like Bitcoin for gains. Inflows of funds and increased demand are likely to drive up prices.”

Rate hikes, lowers, or holds all depend on the economy. Growth in GDP increased at a furious 4.9% pace in quarter three, led by seemingly unstoppable consumer spending. But it’s anybody’s guess what the economy will do next.

GDP and interest rates are early leading indicators

To prevent inflation from spiralling out of control, the Federal Reserve may raise rates again if the economy continues to grow so rapidly. As a result, Bitcoin’s price could be slowed by headwinds.

The Fed will begin seriously considering a round of rate cuts if a year of rate hikes fails to slow growth in 2022.

Bitcoin’s most spectacular rally in history came during the 2020 pandemic due to low interest rates and increased money supply. When the Fed begins cutting rates again, it will raise a massive tailwind of support for rising Bitcoin prices.

WHERE TO CONTACT US:

Website : WWW.CRYPTOTRADE1.COM

Twitter : https://twitter.com/cctrade11

Telegram : https://t.me/cctrade1

Facebook : www.facebook.com/cryptotrade1

Instagram : www.instagram.com/cryptotrade1/

YouTube : www.youtube.com/cryptotrade1

Email : info.cryptotrade1@gmail.com