A bitcoin simply put is a form of cryptocurrency while a Bitcoin ETF aims to replicate the value of bitcoins on the cryptocurrency market.

Bitcoin exchange-traded funds (ETFs) have been the talk of the investment town ever since the SEC gave a green signal for its trading. However, it is important to note that investing in ETFs comes with its risks. With a bunch of investors ready to trade their money, here is all one needs to know about Bitcoin ETFs.

Bitcoin VS Bitcoin ETFs: What is the difference?

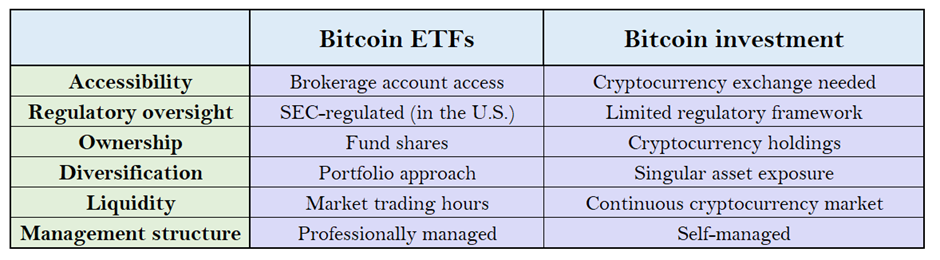

The difference between a Bitcoin and a Bitcoin ETF is quite significant. To understand this, let’s break each term down.

A bitcoin simply put is a form of cryptocurrency in which a record of transactions is maintained, and new units of currency are generated by the computational solution of mathematical problems.

The “spot” market is where bitcoins that are sold for cash are said to trade. The SEC and CFTC do not control the Bitcoin spot market, with a few notable exceptions.

On the other hand, investment firms subject to SEC regulation are ETFs. Securities that need to be registered with the SEC are the shares that the ETF issues. ETFs, like mutual funds, have defined investment goals and employ qualified money managers to help them achieve them.

An investor’s money is pooled via a spot Bitcoin ETF to buy Bitcoin immediately. An investing company oversees a Bitcoin ETF, which is listed on a conventional stock exchange.

ETF investments: how do they work?

In a digital vault, Bitcoin ETFs are safely stored by registered custodians. Bitcoin ETFs attempt to replicate bitcoin’s value on the cryptocurrency market. Before investing in an ETF, bitcoins are purchased from other holders or through cryptocurrency exchanges that are approved by the SEC. Digital wallets often use multiple layers of security to protect tokens.

After that, the ETF issues shares proportional to its bitcoin holdings. Shares of ETFs should be priced according to the current cryptocurrency market price, and the general public can trade them. Due to this, the ETF’s shares try to closely follow bitcoin prices, and it periodically adjusts its holdings by buying or selling coins.

The creation and redemption processes are handled by authorized participants (APs). ETF shares are typically issued or redeemed by big financial institutions in response to market demand. If the ETF shares trade at a premium or discount, the APs produce or redeem them in huge blocks.

Avoiding the FOMO: things to consider before the buy

Before buying Bitcoin ETFs, one should bear in mind the factors that can affect its price, availability, and trading. Before investing in ETFs, it’s important to consider cryptocurrency’s volatility. The price of cryptocurrency and ETFs is interlinked. This means that the slightest volatility in the price of digital assets can result in uncertainty in the ETFs as well.

On the one hand, purchasing spot Bitcoin ETFs streamlines the process of trading and securing bitcoins, but their prices include management fees or expense ratios to cover operating costs, thereby eroding profits over time. For instance, some providers charge up to 1.5% of the ETF’s value annually. This can have a significant cumulative effect, reducing the ETF’s value over time.

Furthermore, Bitcoin lacks regulation by a central authority. The implications of risks like fraud, manipulation, and asset loss are still unclear. Until more thorough oversight and regulations are put in place, risks from under regulation will loom over the larger market.

WHERE TO CONTACT US:

Website : WWW.CRYPTOTRADE1.COM

Twitter : https://twitter.com/cctrade11

Telegram : https://t.me/cctrade1

Facebook : https://www.facebook.com/cryptotrade11

Instagram : www.instagram.com/cryptotrade1/

YouTube : www.youtube.com/cryptotrade1

Email : info.cryptotrade1@gmail.com