Doubtless, Decentraland and Sandbox are top 2 Metaverse projects and compared for you.

Now that Facebook has virtualized the term Metaverse, it seems like everyone wants to get into the Metaverse or aMetaverse. This has benefited the crypto Metaverse platforms, especially the leading ones. Either MANA and SAND are on my 5 Metaverse potfolio too.

Look no further than Decentraland, for example. Its native token MANA has rallied more than 400% since October 28th. Similarly, look at SAND, the Sandbox native token, which has rallied more than 300% since that time.

Analyzing the token growth alone is not enough to get a true sense of, which platform will be a leader in the Metaverse space, and so in this post, we are comparing Decentraland to the Sandbox in an effort to better help you make purchasing decisions. Stick around to the end of this post. That’s when we’re gonna share our opinion as to which one is a better choice.

If you are unfamiliar about Metaverse, you can read my the most recent Medium post regarding Top 10 Metaverse Project.

Decentraland MANA and The Sandbox SAND Recap

First, let’s introduce both Metaverse platforms, which are being considered today, and we’ll start with Decentraland, whose ticker is MANA.

Next up, we have the Sandbox, whose ticker is SAND. The Sandbox is a virtual world where players can build their own and monetize their gaming experiences in the Ethereum blockchain using SAND, the platform’s utility token. This platform aims to create an immersive Metaverse in, which players will create virtual worlds, and games collaboratively and without a central authority.

Wallets for MANA and SAND

Let’s give some consideration to the wallets of each platform. From the site of Decentraland, its native token MANA has the ERC20 standard. However, Decentraland has recently made a bridge with wallet connect, which allows Polygon users to participate as well.

On the other hand, SAND, the Sandbox native token, is also an ERC20 token. What this means is that you can use any ERC20 wallet in the market for both projects, and the most common one displayed here is My Ether Wallet; however, you can also use Metamask, if that’s your preference or even Trustwallet, as far as wallets go we’re giving this one to Decentraland.

Scalability

Let’s discuss scalability next. Considering that both projects are built on top of the Ethereum blockchain, their scalability capacity is limited because of the following factors.

First of all, very high fees, and unfortunately, many of us are painfully familiar with this, so fees are paid in Ether, whose price right now is quite variable, and there’s a lot of volatility in these fees.

Another factor is unstable tokens. The Ethereum blockchain is still undergoing a lot of changes, and this includes moving the consensus mechanism from Proof of Work (PoW) to the Proof of Stake (PoS), or system under the PoW mechanism, Ethereum has 20 transactions per second. However, when ETH point 2 arrives, this blockchain will have 20,000 transactions per second approximately. That’s three orders of magnitude higher both projects don’t really have enough scalability capacity to adapt to massive adoption. However, this will improve when the ETH 2.0 Proof of Stake (PoS) protocol arrives, so for the time being, we’re calling this one a tie.

Governance

Let’s now consider governance. Decentraland has two tokens, LAND, which is the non-fungible parcels in, which the virtual world is divided, and Decentraland also offers MANA ERC20 “token that is burned to claim LAND as well as to make in-world purchases of goods and services.”

Therefore Decentraland has a DAO, a Decentralized Autonomous Organization, where the community will vote for things like purpose, and voting on policy updates future LAND auctions, “whitelisting of NFT non-fungible token contracts to be allowed inside the world builder and marketplace, and really whatever the community deems relevant, and other issues as well.”

Governance voting takes place on the Decentraland DAO governance interface, which is powered by Aragon.

On the other hand, in the Sandbox, users need SAND to participate in governance decisions of the platform via a DAO structure. Some examples of voting include foundation grant attributions to content, and game creators, feature prioritization on the platform roadmap, the delegation of voting rights to other players of their choice, and other variables as well.

In conclusion, the governance mechanism for both projects have very similar functions, but Decentraland has a more structured voting platform, and it’s easier to find on their website. That’s why the winner, in this case, is Decentraland.

The Team

We have to discuss the team of each project. It is beginning with Decentraland who have a security advisory board SAB that acts as a guarantor of Decentraland’s smart contract security.

This team aims to oversee the work of the DAO committee and respond to vulnerability and bug reports in any of Decentraland’s contracts. Also, the SAB includes five Solidity experts that have initially been selected by the Decentraland development team.

The Decentraland team has important leaders in blockchain engineering, computer science, venture capital, and data analytics, and so they have a lot of variety in terms of their pedigrees and their backgrounds, which we always view to be a strength.

On the other hand, the Sandbox team is distributed in four different countries specialized in startups, and software development, finance as well as blockchain business.

Here we’re noticing that Decentraland has three members in its team, whereas Sandbox has five members of its core team, plus five advisors. There are more possibilities that the Sandbox team will have better developments, and thus the Sandbox wins this particular round, in our humble opinion.

Purchasing Lands

Let’s talk about purchasing lands. The community owns the land in Decentraland and the Sandbox forever. This allows them complete authority over their projects. Therefore landowners have authority over what material is published on their parcels of land, which is denoted by a set of cartesian coordinates.

As a result, the land is a digital asset that is non-fungible transferable and rare that is kept in an Ethereum smart contract. It may be obtained by using an ERC20 token known as MANA. To buy lands in Decentraland, you have to go to connect your wallet, and go to the marketplace, and browse in the parcel and estates section.

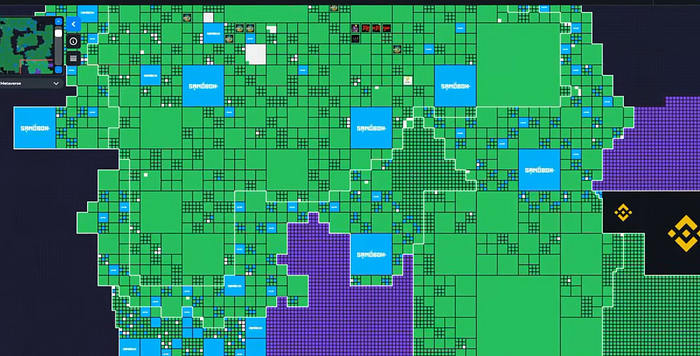

At that point, you have to put the on sale option on, and then you’ll see that the sky blue squares will appear. These are all the available lands you can buy in Decentraland. The best criteria to choose the best lands are the same reality as you would have in real life in the real world. “You have to look for lands near strategic places where people gather and spend time location as any real estate agent will tell you.”

For example, universities, casinos, other recreational places where people congregate will give your lands higher value quickly and will make better returns over time.

For example, browsing in the marketplace, you can see in the picture that near the Genesis Plaza, there are some lands very near it, and this is a big opportunity. This would be considered hot real estate.

To buy lands in the Sandbox, you have two options, shown here, you have the Sandbox marketplace, but in addition, you can also purchase lands on Opensea, which is shown here.

You only have to connect your wallet choose the land, and then pay also, there’s a P2P NFT trader where people can swap their Sandbox, NFTs in a secure and easy way, and the best way to buy affordable lands in the Sandbox is by browsing in the marketplace, then writing down the coordinates of each land, and then looking to see if it’s located near the land of a partnered company on the map.

For example, here, there is a land whose coordinates are minus -171,22, and this can be purchased in Opensea. You can put them in the coordinates section on the map to see if it’s near commercial lands.

Recent Developments

We’re still discussing purchasing lands, but as a subsection here, we want to consider recent developments. It’s important to note that Decentraland has announced new partnerships and developments like an open virtual gallery here with Sotheby’s.

Something that’s known as the wearable editor, and they’ve also announced the ability for users to shoot and edit videos inside the platform.

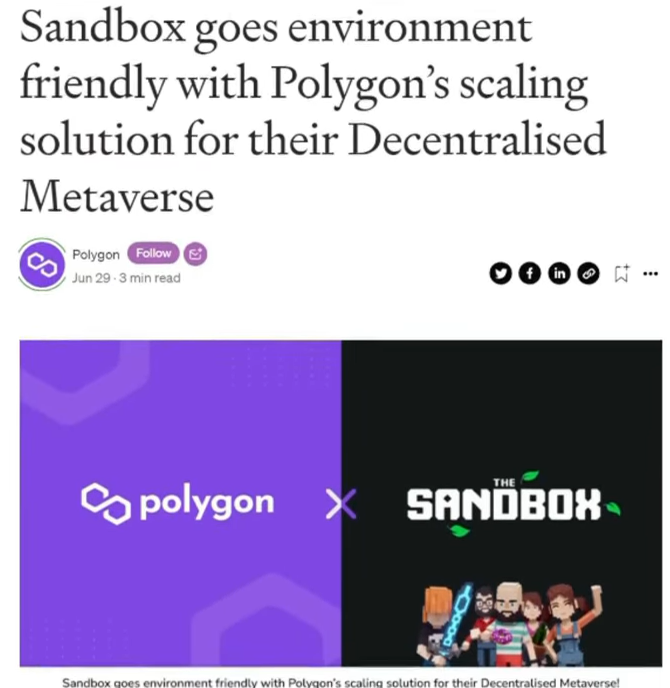

On the other hand, the Sandbox’s newest developments are the fact that it migrated to a Polygon NFT layer 2 to use 100 times less energy than Ethereum.

They’ve also recently announced their liquidity mining launch. In conclusion, both Metaverse platforms are constantly developing new features. However, the Sandbox’s NFT migration is a critical improvement for the platform that may very well allow for exceptional scalability. Therefore in this particular case, the Sandbox wins.

Partnerships

We are talking partnerships. Beginning with Decentraland, they have partnered with Cyberpunk, Polygon aka MATIC, and Atari, to name just a few.

While that may sound impressive, on the other hand, we have the Sandbox, which is partnered with Opensea, The Walking Dead.

They have also partnered with Atari, socios.com, a favourite of ours because it’s affiliated with Chiliz’s CHZ, of course, Binance, Mr Snoop Dogg, Ultra, Coinmarketcap, the South China morning post WAX, Maker, Crypto Kitties, Opera, and Flows.

As far as partnerships go, we have to give this one to the Sandbox hands down, as it just has an abundance of partnerships.

Platform Access

Let’s consider access for a second. Decentraland has a guest mode where anyone can start playing in their Metaverse without necessarily having to connect to any related wallet. However, this means that the experience inside the game is very limited, and the information will be stored on the platform.

The Sandbox you need to register first via an email, a social media account, or Gmail, or if you prefer, by Metamask. For this one, we think that the Sandbox gives users more access alternatives, and that’s why narrowly, but that is why we think that the Sandbox wins this round.

Token Analysis

Who’s ready for some token analysis. “Beginning with Decentraland, whose native token MANA is an ERC20 token and has multiple use cases and features such as the ability to make in-game purchases such as claiming land ownership, it has a fixed supply of 2.1 billion tokens. It allows you to pay fees when a parcel is purchased, and you can pay Decentraland development infrastructure costs with it as well. It’s also burned to claim LAND, and this means that users use MANA to buy parcels.”

As I just mentioned, Decentraland has another token called LAND, which is an ERC72 token; it’s an NFT used to distribute lands in the Metaverse, and it’s used by developers to build in that same Metaverse.

On the other hand, we have the Sandbox, which has not only its native token called SAND but also has multiple class fungible tokens and MCFT. SAND’s use cases are the following it’s, first of all, a platform utility token, but it also provides developers true ownership of their creations as NFTs. It offers rewards participation. It allows users to upload, publish, sell assets represented in ERC721 and ERC1155 standards.

Users can trade digital assets, it’s used for governance voting, and there’s also a fee capture model wherein 5% of transaction fees are allocated in a staking pool as rewards for token holders. Staking rewards for token holders as well, and company reserves, which is 20% of the total token supply.

Moreover, the Sandbox has ASSETS tokens that are an ERC1155 standard, which is used to represent a mix of a cryptocurrency and an NFT in the same asset. We feel that this may be perfect for the Metaverse.

Finally, the Sandbox also has developed two more tokens these are GEMS ERC20 tokens are burned to give attributes to the assets tokens, and also CATALYSTS ERC20 tokens are burned to mint assets tokens to let users associate a number of GEMS tokens to ASSET tokens.

We feel the Sandbox wins in this particular factor by far because they’ve developed way more than token development giving their Metaverse optimized features.

The Final Verdict

In conclusion, and considering all of these factors that we’ve analyzed here, we can confidently say that the Sandbox offers not only a truer but a more technically comprehensive platform that is ready to dominate the Metaverse.

Decentraland, along with MANA, is great. We just feel that the Sandbox is in a better position to really be a leader in this space, head and shoulders above everybody else.

❤️❤️

Thank you for your love and support to the Cryptotrade1.