Missed The Boat?

A lot of people feel they have missed the crypto bull run for the last few years. This is my answer to them:

The boat is gone and is transforming to a bigger ship. Don’t miss the ship.

About Myself

I invest in cryptocurrency since 2016. I am both a long term and a lazy investor i.e. mainly I HODL (buy and don’t sell).

To my surprises, laziness works in cryptocurrency investment, and patience is a by-product of my laziness.

Just buy it and forget about it, provided you are buying the right coins. I made my small share of mistakes chasing some crazy altcoins in 2018, learned my lessons and would like to share with you the list of long term coins I personally invested lazily for the next 2 years.

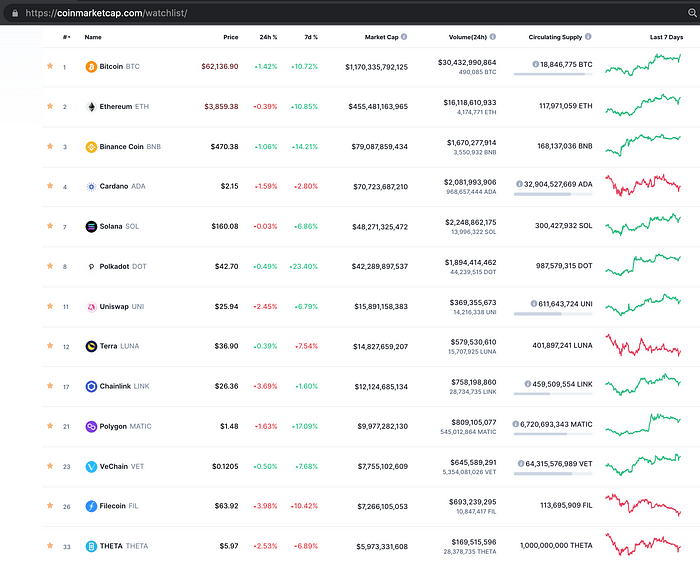

My Long Term Cryptocurrency Investment List

Bitcoin (BTC) and Ethereum (ETH) are the foundations of your crypto investments. Get some in your portfolio. Below are the other coins that I have invested for the next two years.

Binance Coin (BNB): As an exchange, Binance is 5 times bigger than Coinbase Exchange in terms of daily volume. Binance has a daily volume of $17B as of this writing.

Cardano (ADA): Cardano, like Ethereum, allows development of smart contracts and is designed as Proof-of-Stake (PoS) network from the beginning. Cardano will also launch an ERC-20 token converter to migrate assets from Ethereum to Cardano and vice versa.

Solano (SOL): The Solana network can process 65,000 transactions per second at an average cost of just $0.00025 per transaction, making it much faster and cheaper than Ethereum. According to the Solana white paper, the network could theoretically process 710,000 transactions per second (TPS) using a 1 gigabit per second network connection.

Polkadot (DOT): Polkadot enables cross-blockchain transfers of any type of data or asset, not just tokens. Through Parachains, Polkadot enables a diverse ecosystem of independent platforms and communities.

Uniswap (UNI): Uniswap is an Automated Market Maker-based (AMM-based) decentralized exchange (DEX) which allows for automated transactions between cryptoc urrency tokens on the Ethereum blockchain. With the surging interest in cryptocurrencies, we expect the volume in Uniswap to go up.

Terra (LUNA): Terra is a next-generation blockchain payment network powered by its own LUNA coin for the digital economy. For example, its Anchor Protocol allows Terra users to create synthetic assets which mimic the behavior of real-world assets such as stocks e.g. mTSLA for Tesla stock. Other protocols are Anchor Protocol. Buy at Crypto.com, Voyager, Binance.

Chainlink (LINK): Chainlink is the preferred blockchain oracle provider for nearly all projects and is the most integrated service in the crypto ecosystem. Buy LINK for its network effects. A blockchain oracle is a third-party service that connects smart contracts with the outside world i.e. it integrates blockchain with the other systems that we have today. Integration is a HUGE market.

Polygon (MATIC): Polygon is a blockchain that sits on top of the Ethereum network and processes transactions quickly with lower fees through sidechain. Polygon is developed for Ethereum but can be expanded to other blockchains.

VeChain (VET): VeChain is designed for supply chain management to streamline business processes and information flow for complex supply chains. VeChain has an extensive list of partnerships with various suppliers including DNV GL, BMw, LVMH etc. See this link for complete list:

Filecoin (FIL): Filecoin is a decentralized data storage and sharing network. Data and storage are essential in any network and has good real world use case.

Theta (THETA): Theta is a decentralized Content Delivery Network to help video platforms (e.g. YouTube, Netflix) to decrease cost of content delivery by offloading bandwidth from legacy CDNs to home/office computers which will share their unused bandwidth. It is like AirBnB or Uber for home internet. Theta has a very good immediate real world use case.

Enjin (ENJ): Crypto Gaming and NFTs are up and coming. Enjin creates and manages virtual goods, including in-game items, both fungible and non-fungible, on the Ethereum blockchain. In fact, they are the creator of ERC-1155 token standard which allows the issuance of both fungible and non-fungible tokens (NFT), an important component for any game developer implementing crypto assets into their game. Enjin can help reduce the high fees and fraud that have plagued the transfer of virtual in-game goods and collectables.

Decentraland (MANA): Decentraland is a shared virtual world, much like the Metaverse described by author Neal Stephenso. Unlike other virtual worlds such as Second Life, it is not controlled by a centralized organization hence the name Decentraland. Users can buy, develop, and sell LAND, a non-fungible ERC-721 token that represents the ownership of virtual land in Decentraland. Users can purchase LAND as well as all other goods and services in Decentraland with MANA, a fungible ERC-20 token. Each parcel of LAND is unique and owners get to choose what content they want to publish on their portion land, which can range from a simple, static scene to an interactive game or even a virtual NFT gallery. In fact, many NFT Art collectors have taken to blockchain-based virtual worlds like Decentraland and Cryptovoxels to build their galleries.

Rarible (RARI): Rarible is a popular Ethereum marketplaces which allows creation, buying, and selling of NFTs. Users on the Rarible platform can easily create NFTs for unique digital items like artworks, game items and more.

Do Your Own Research (DYOR)

I encourage you to do your own research.

Decentralized Applications (Dapps) are digital applications or programs that exist and run on a blockchain or P2P network of computers instead of a single computer, and are outside the purview and control of a single authority.

To ensure your coin has actual real-world use cases, do some research on Dapps (Decentralized Apps) for each coin. Here are some of the top Dapps for major ecosystems: Ethereum, Binance and Polygon.